- 1. Understanding EPS

- 2. Share Options and Their Impact on EPS

- 3. Convertible Loan Stock and Its Impact on EPS

- 4. Calculating the Impact on EPS

- 5. Practical Tips for Your Assignment

- Conclusion:

In the realm of financial accounting, the impact of share options and convertible loan stock on Earnings Per Share (EPS) is a critical area of study that can significantly influence a company’s financial statements. For students completing their accounting assignments, understanding this impact is essential for accurate financial analysis and reporting.

Share options and convertible loan stock are financial instruments that can alter the number of shares outstanding and, consequently, affect EPS. Share options grant employees or executives the right to purchase company stock at a set price, which can lead to an increase in the number of shares when exercised. This increase can dilute EPS, as net income is spread over a larger number of shares. Convertible loan stock, on the other hand, are debt securities that can be converted into equity shares. When converted, these securities increase the number of shares outstanding and can similarly dilute EPS.

The significance of these instruments lies in their dual impact on both the number of shares and the financial metrics used in EPS calculations. For students seeking help with share assignment, understanding how to adjust EPS calculations to reflect potential dilution from share options and convertible loan stock is crucial. Mastery of these effects not only aids in solving assignments but also enhances the ability to interpret financial statements comprehensively.

In academic settings, analyzing the impact of share options and convertible loan stock on EPS provides valuable insights into corporate finance strategies and financial reporting. Mastery of this topic equips students with the skills to perform detailed financial analyses, making it a crucial component of accounting education and a common subject in related assignments.

1. Understanding EPS

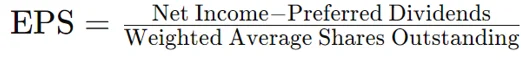

Earnings Per Share (EPS) is a key financial indicator that represents the portion of a company's profit attributed to each outstanding share of common stock. It is calculated using the formula:

EPS serves as a measure of a company’s profitability on a per-share basis, making it an important metric for investors and analysts to assess the company's financial performance and compare it with other companies.

2. Share Options and Their Impact on EPS

Share options, also known as stock options, are contracts that give employees or executives the right to purchase company stock at a predetermined price. These options can affect EPS in several ways:

- Dilution Effect: When share options are exercised, new shares are issued to the option holders. This increases the total number of shares outstanding, which can dilute the EPS. For example, if a company issues 1,000 new shares as a result of exercised options, the weighted average shares outstanding increases. If the net income remains unchanged, the EPS will decrease because the profit is now distributed over a larger number of shares.

- Basic vs. Diluted EPS: Financial statements present both basic and diluted EPS. Basic EPS is calculated using the current number of shares outstanding, without considering the potential impact of securities that could convert into shares. Diluted EPS, on the other hand, accounts for the potential dilution from convertible securities such as share options. It provides a more conservative view of the company's earnings per share by including the potential effects of share options and other dilutive instruments.

3. Convertible Loan Stock and Its Impact on EPS

Convertible loan stock, also known as convertible bonds, are debt instruments that can be converted into a specified number of shares of common stock. The impact of convertible loan stock on EPS involves a few key considerations:

- Conversion Effect: When convertible loan stock is converted into equity, the number of shares outstanding increases. This can dilute the EPS, similar to the impact of share options. However, the effect on EPS is influenced by additional factors. The conversion increases the total number of shares, which can reduce EPS if the net income does not increase proportionately.

- Interest Savings: A significant aspect of convertible loan stock is the potential elimination of interest payments if the bonds are converted into shares. When convertible debt is converted, the company no longer has to pay interest on the debt, which can lead to an increase in net income. This reduction in interest expenses can partially offset the dilution effect and potentially improve the EPS, even though the number of shares has increased.

4. Calculating the Impact on EPS

To accurately assess the impact of share options and convertible loan stock on EPS, follow these steps:

- Calculate Basic EPS: Start by calculating the basic EPS using the standard formula. This involves dividing the net income minus any preferred dividends by the weighted average number of shares outstanding.

- Determine Diluted EPS:

- For Share Options: Adjust the number of shares outstanding to include the potential shares from exercised options. Use the treasury stock method, which assumes that the proceeds from the exercise of options are used to repurchase shares at the average market price.

- For Convertible Loan Stock: Adjust the net income by adding back any interest expenses that would have been saved if the bonds were converted. Then, increase the number of shares outstanding by the number of shares that would be issued upon conversion of the bonds.

- Compare Basic and Diluted EPS: Analyzing the difference between basic and diluted EPS helps in understanding the potential dilution effects. Diluted EPS provides a more cautious view of a company’s earnings per share, considering the possible effects of share options and convertible securities.

5. Practical Tips for Your Assignment

- Refer to Financial Statements: Review the company's financial statements and accompanying notes for detailed information on share options and convertible securities. These documents provide crucial insights into how these instruments affect EPS calculations.

- Understand the Context: Consider the broader financial strategy and capital structure of the company. How do share options and convertible debt fit into the company’s overall financial plan?

- Use Reliable Sources: Ensure that your calculations are based on accurate and up-to-date financial data. Refer to accounting standards and guidelines to ensure that your treatment of these instruments is in line with accepted practices.

Conclusion:

In conclusion, understanding the impact of share options and convertible loan stock on Earnings Per Share (EPS) is crucial for accurately interpreting financial statements and completing accounting assignments. Share options can dilute EPS by increasing the number of outstanding shares, and it is essential to differentiate between basic and diluted EPS to reflect this potential dilution accurately. Convertible loan stock further complicates EPS calculations by introducing both dilution effects and potential savings from reduced interest expenses, making it vital to account for both the increase in shares and adjustments to net income.

By mastering these concepts, students can enhance their analytical skills and provide more precise financial assessments in their assignments. Detailed knowledge of how these financial instruments affect EPS not only supports accurate assignment completion but also fosters a deeper understanding of corporate financial strategies.